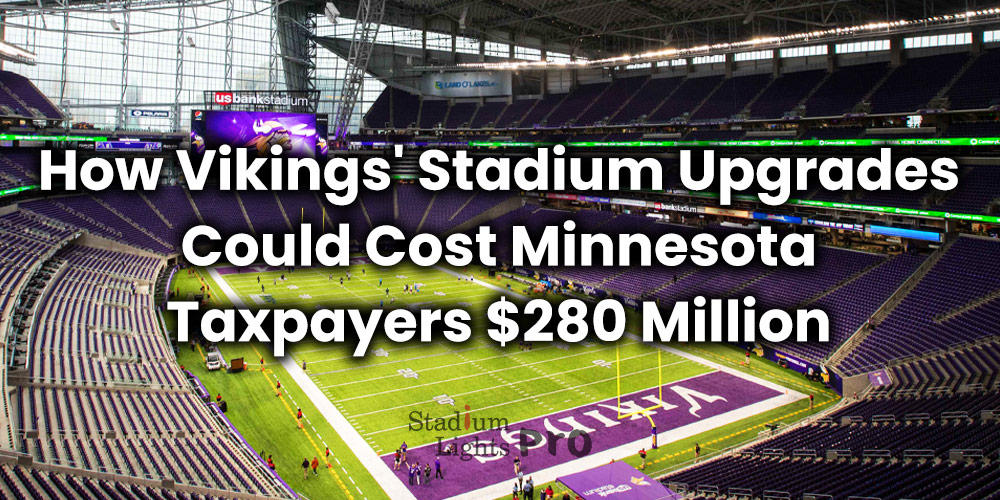

In just seven years since U.S. Bank Stadium was built in Minneapolis with nearly $500 million in taxpayer funds, additional maintenance costs of up to $280 million over the next ten years could fall on the taxpayers. Despite being a relatively new stadium, it urgently requires several major upgrades that the reserve fund does not have sufficient funds to cover, as reported by the Minneapolis-based Star Tribune.

While there is around $16 million currently allocated for maintenance costs, expenses are expected to rise to $48 million next year, putting taxpayers on the hook for the difference. Michael Vekich, the chair of the Minnesota Sports Facilities Authority, has acknowledged that there isn’t enough money to cover these expenses, and it is up to the stadium operator, ASM, the Minnesota Vikings, the governor, and the legislature to find a solution.

Taxpayers are becoming increasingly concerned about the feasibility of funding pricey sports facilities with public money, especially when the maintenance costs are not adequately planned or considered. This situation has brought attention to the importance of careful consideration and planning in similar public projects to ensure their long-term financial sustainability, given the significant amount of money involved.

Taxpayers are becoming increasingly concerned about the feasibility of funding pricey sports facilities with public money, especially when the maintenance costs are not adequately planned or considered. This situation has brought attention to the importance of careful consideration and planning in similar public projects to ensure their long-term financial sustainability, given the significant amount of money involved.

Apart from the $280 million maintenance costs, taxpayers are also responsible for the expenses of security upgrades around the U.S. Bank Stadium. These upgrades amounted to $15.7 million, which was included in the state budget, and an additional $48 million to complete the perimeter, according to Michael Vekich, chair of the Minnesota Sports Facilities Authority.

The U.S. Bank Stadium situation serves as a cautionary tale about the high cost of publicly funded stadiums. It highlights how expenses can continue to pile up even after construction is complete, which contradicts the argument made by advocates of public stadium subsidies who claim that such projects will eventually pay for themselves by generating economic growth. This argument has been refuted by numerous studies, and the need for taxpayers to cover maintenance costs further reinforces this point.

Moreover, there is a significant conflict of interest at play, as pointed out by Neil deMause, a stadium subsidy skeptic. The list of necessary upgrades to U.S. Bank Stadium was created by Populous, a stadium design and construction firm that is likely to bid on future work. This scenario is akin to a car salesman urging a buyer to purchase a new car while someone else pays for it.

The need for continuous financial assistance for maintenance has now become a common issue for publicly funded stadiums, including those in Minneapolis, Cincinnati, and Maryland. To fund $500 million in upgrades for its 23-year-old football stadium, Cincinnati is also facing financial difficulties. In Maryland, a $1.2 billion fund was set up last year to support stadium facilities’ renovations, with the Baltimore Ravens and Baltimore Orioles being the primary beneficiaries.

The significant property tax exemptions provided to these stadiums by cities are one of the main reasons for these public projects’ failure to pay for themselves. According to a recent report by the Independent Budget Office of New York City, the city’s four major stadiums, including Barclays Center, Citi Field, Madison Square Garden, and Yankee Stadium, are exempt from approximately $377 million in annual property taxes.

The IBO report also indicates that the other three stadiums, excluding Madison Square Garden, are exempt because they were built on publicly owned land that is not subject to property taxes. However, stadiums should not be viewed as public parks open to everyone, and it is essential that cities abandon this notion and take action to address the ongoing financial burden associated with these projects.

The IBO report’s crucial discovery is that the economic activity generated by these types of subsidies is not adequate to result in a positive fiscal impact on the local area. In other words, the financial benefits that cities expect to receive from subsidizing stadiums do not justify the costs. The report challenges the common argument made by supporters of stadium subsidies that these projects will pay for themselves by generating economic growth. The IBO report’s finding implies that the revenue generated from stadiums and the taxes collected from the additional economic activity are not enough to offset the costs associated with building and maintaining these facilities.